Bitcoin Halving Impact, Market Trends, and Future Outlook

Updated: July 11, 2025

Intro: Bitcoin’s Global Moment in Nashville

The Bitcoin 2024 Conference, held from July 25–27, 2024, at the Music City Center in Nashville, Tennessee, marked a historic milestone as the largest Bitcoin-focused event to date, drawing over 20,000 attendees from across the globe. Convened three months after Bitcoin’s fourth halving on April 20, 2024, the conference united a diverse audience, including retail investors, institutional leaders, developers, miners, regulators, policymakers, and fintech innovators, to assess Bitcoin’s evolving role in the global financial ecosystem.

The halving, which reduced the block reward from 6.25 BTC to 3.125 BTC, intensified Bitcoin’s programmed scarcity, sparking discussions on its economic, technological, and societal implications. This comprehensive, fact-checked report, written on July 28, 2024, expands to approximately 4,000 words to provide an in-depth analysis of the conference’s key takeaways. Tailored for Ghost CMS in Markdown format, it includes structured tables, FAQs, and key insights, enhanced with emojis for visual appeal, ensuring clarity and accessibility for both newcomers and seasoned stakeholders.

🌟 The Bitcoin Halving: A Pivotal Economic Mechanism

Read About The History of Bitcoin

Understanding the Halving

Bitcoin’s protocol, created by Satoshi Nakamoto, includes a halving event roughly every four years, or every 210,000 blocks. This mechanism reduces the reward miners receive for validating transactions, controlling the issuance of new coins.

The fourth halving took place on April 20, 2024, at block 840,000. It reduced the block reward from 6.25 BTC to 3.125 BTC, further slowing the creation of new Bitcoin.

Bitcoin has a fixed supply cap of 21 million coins. As of July 2024, approximately 19.7 million BTC were in circulation, according to Blockchain.com. This leaves about 1.3 million coins to be mined over the coming decades.

Halvings are designed to control Bitcoin’s inflation rate, making it increasingly scarce. This reinforces Bitcoin’s value as a deflationary asset, distinguishing it from traditional fiat currencies.

Historically, halvings have led to significant price increases due to reduced supply issuance. However, outcomes depend on factors like macroeconomic conditions, adoption trends, and market sentiment.

The 2024 halving occurred during a period of global inflation concerns, growing institutional interest, and technological advancements in the Bitcoin ecosystem. These factors could drive significant economic shifts in the cryptocurrency market.

Economic and Market Impacts

📈 Price Dynamics

Post-halving, Bitcoin’s price fluctuated between $55,000 and $70,000, according to CoinGecko and CoinMarketCap data, reflecting a consolidation phase with reduced volatility. The 30-day annualized volatility dropped to 28–33%, among the lowest in five years, signaling growing investor confidence and Bitcoin’s evolution into a stable store of value. This stability contrasts with the sharper price swings following previous halvings (e.g., 2020’s 50–60% volatility), indicating a maturing market.

💰 Market Capitalization

Bitcoin’s market capitalization stabilized between $1.1 trillion and $1.3 trillion through July 2024, maintaining its dominance as the leading cryptocurrency with approximately 50% of the total crypto market cap, per CoinMarketCap. This resilience underscores Bitcoin’s role as the cornerstone of the digital asset ecosystem, even amid competition from altcoins.

⚡ Mining Network Resilience

The global hash rate averaged 580 exahashes per second (EH/s) in Q2 2024, per Blockchain.com, demonstrating robust mining activity despite reduced block rewards. Miners adapted through advanced hardware, energy-efficient operations, and geographic diversification, ensuring network security remained uncompromised.

Bitcoin Halving Impact Overview (April–July 2024)

| Metric | Pre-Halving (Q1 2024) | Post-Halving (Q2 2024) |

|---|---|---|

| Block Reward | 6.25 BTC | 3.125 BTC |

| Price Range | $40,000–$73,000 | $55,000–$70,000 |

| Market Cap | $0.8T–$1.4T | $1.1T–$1.3T |

| Hash Rate (EH/s) | ~550 | ~580 |

| Volatility (30-day) | 35–40% | 28–33% |

Mining Industry Adaptations

Read About The Best Crypto Minin Equipment

🌎 Geographic Diversification

The mining landscape continued to evolve, with operations gravitating toward regions offering affordable, sustainable energy. Texas emerged as a global mining hub due to its deregulated energy market, abundant wind, and solar resources. Northern Europe, particularly Norway and Sweden, attracted miners with low-cost hydroelectric power. In Latin America, countries like Paraguay and Argentina leveraged hydropower to expand mining operations, contributing to regional economic development.

🔧 Hardware Efficiency

The widespread adoption of next-generation ASIC miners, such as Bitmain’s S19 XP (140 TH/s, 21.5 J/TH) and MicroBT’s WhatsMiner M50 (126 TH/s, 20.5 J/TH), improved energy efficiency and profitability. These advancements mitigated the impact of reduced block rewards, allowing miners to maintain operations despite higher operational costs.

🌿 Environmental Initiatives

The Bitcoin Mining Council’s Q2 2024 report estimated that 50% of Bitcoin mining relied on renewable energy sources, including hydroelectric, wind, and solar, up from 37% in 2021. Initiatives like the Crypto Climate Accord and partnerships with energy providers further reduced Bitcoin’s environmental footprint, countering criticisms of its energy consumption compared to traditional financial systems like banking or gold mining.

Key Takeaways: Mining Trends

- 🌎 Texas and Scandinavia: Leading hubs for sustainable mining.

- 🔧 ASIC Efficiency: S19 XP and M50 reduce energy costs.

- 🌿 Renewables: ~50% of mining energy, per Bitcoin Mining Council.

Technological Advancements: Scaling and Enhancing Bitcoin

The Future of Bitcoin Scalability

The Bitcoin 2024 Conference showcased a vibrant developer ecosystem driving technical innovation. Key advancements included Taproot, the Lightning Network, sidechains, and cross-chain interoperability, each expanding Bitcoin’s functionality and accessibility.

🔒 Taproot and Schnorr Signatures

Activated in November 2021, the Taproot upgrade, enabled by Schnorr signatures, achieved ~50% adoption in Bitcoin transactions by July 2024, per Bitcoin Core data. Taproot offers three primary benefits:

- Signature Aggregation: Combines multiple signatures into a single one, reducing transaction size by ~20% and lowering fees, particularly for complex transactions like multisig.

- Enhanced Privacy: Makes complex transactions (e.g., multisig or smart contracts) indistinguishable from simple ones on-chain, bolstering user privacy.

- Smart Contract Flexibility: Enables more expressive scripting, supporting trustless applications like escrow services, decentralized exchanges, and DeFi protocols.

These features have spurred the development of privacy-focused wallets (e.g., Wasabi Wallet) and advanced Bitcoin-native DeFi platforms, positioning Bitcoin as a versatile platform beyond simple payments.

⚡️ The Lightning Network: Scaling for Everyday Transactions

The Lightning Network, Bitcoin’s Layer 2 scaling solution, facilitates near-instant, low-cost transactions by processing them off-chain while leveraging Bitcoin’s security. As of July 2024, per 1ML.net:

- Nodes: Approximately 18,000 public nodes, up from 15,000 in 2023.

- Channel Capacity: 5,000 BTC ($325M at $65,000/BTC).

- Transaction Fees: Below 1 satoshi per byte, making micropayments viable.

Major platforms, including Cash App, Strike, and Bitfinex, have integrated Lightning for payments, remittances, and merchant services. Recent upgrades, such as improved payment routing algorithms and liquidity management tools, addressed challenges like channel balancing and payment reliability. However, user experience remains a barrier, with ongoing efforts to simplify wallet interfaces and onboarding processes. Conference workshops showcased tools like Phoenix and Muun wallets to enhance accessibility.

🌐 Sidechains and Cross-Chain Interoperability

Sidechains extend Bitcoin’s functionality by enabling specialized use cases while maintaining compatibility with the main chain:

- Liquid Network: Operated by Blockstream, Liquid supports confidential transactions and rapid settlement for institutional traders. It processed ~$500M in transaction volume in 2024, per Blockstream metrics.

- Rootstock (RSK): A Bitcoin sidechain enabling Ethereum-compatible smart contracts, RSK hosts DeFi protocols and tokenized assets, with a Total Value Locked (TVL) of $200M (DeFiLlama, July 2024).

- Cross-Chain Bridges: Projects like tBTC and RenBTC connect Bitcoin to Ethereum, Solana, and other blockchains, enabling interoperability for DeFi and tokenized assets.

Key Takeaways: Bitcoin Technologies

- 🔒 Taproot: Enhances privacy and smart contract capabilities.

- ⚡️ Lightning Network: Enables fast, low-cost micropayments.

- 💼 Liquid Network: Supports institutional trading with confidentiality.

- 🌐 RSK: Brings DeFi to Bitcoin via smart contracts.

💸 Bitcoin-Native DeFi: Opportunities and Challenges

Integrating RWA Assets on Blockchain

Bitcoin-based decentralized finance (DeFi) is gaining momentum, though it remains smaller than Ethereum’s ecosystem. Per DeFiLlama, Bitcoin DeFi’s TVL reached $900M by July 2024, driven by platforms like:

- Stacks: A Layer 1 blockchain anchored to Bitcoin, enabling smart contracts and decentralized applications (dApps).

- Sovryn: A Bitcoin-native DeFi platform offering lending, borrowing, and trading.

- ALEX: A decentralized exchange (DEX) on Stacks, supporting tokenized Bitcoin assets.

Opportunities

- Scalability: Layer 2 solutions like Lightning and sidechains like RSK expand Bitcoin’s DeFi potential.

- Security: Bitcoin’s robust security model attracts risk-averse users to DeFi protocols.

- Interoperability: Cross-chain bridges integrate Bitcoin with Ethereum and other ecosystems, unlocking new use cases.

Challenges

- Complexity: Limited wallet compatibility and technical barriers hinder user adoption.

- Liquidity: Bitcoin DeFi’s TVL is ~1.5% of Ethereum’s $60B (July 2024).

- Education: Users require better resources to navigate DeFi safely.

Conference sessions addressed these challenges through developer workshops, hackathons, and demonstrations of user-friendly wallets and educational tools.

🏦 Institutional Adoption: Bitcoin Goes Mainstream

Best 5 Bitcoin Wallets

Corporate Treasury Allocations

Institutional adoption accelerated in 2024, with companies viewing Bitcoin as a hedge against inflation and currency devaluation. MicroStrategy, a pioneer in corporate Bitcoin adoption, held 205,000 BTC (~$13.3B at $65,000/BTC) as of Q2 2024, per SEC filings. Other firms, including Tesla (holding ~43,000 BTC) and Square, maintained or expanded Bitcoin allocations. Hedge funds and asset managers, such as BlackRock and Fidelity, launched Bitcoin-focused investment products, signaling growing mainstream acceptance.

Bitcoin ETFs and Custodial Services

Bitcoin exchange-traded funds (ETFs) saw significant inflows, with $8B invested in 2024, per Bloomberg. U.S.-based ETFs, managed by Grayscale, Fidelity, and ARK Invest, provided regulated exposure to Bitcoin, attracting both institutional and retail investors. Key custodial services expanded to meet demand:

- Coinbase Custody: Manages over $100B in digital assets, offering institutional-grade security.

- Fidelity Digital Assets: Serves pension funds and family offices with Bitcoin custody and trading.

- BitGo: Enhanced multi-signature wallet solutions for secure storage.

Top Bitcoin ETFs (July 2024)

| ETF Provider | Assets Under Management | Inflows (2024) |

|---|---|---|

| Grayscale | $25B | $3.5B |

| Fidelity | $10B | $2.0B |

| ARK Invest | $5B | $1.5B |

🧑💻 Retail Adoption: Empowering Everyday Users

Retail adoption surged, driven by accessible platforms and educational initiatives:

- PayPal, Venmo, and Robinhood enabled millions to buy, hold, and spend Bitcoin, lowering entry barriers.

- Mobile wallets like Muun, Phoenix, and BlueWallet integrated Lightning Network support, simplifying micropayments for everyday use.

- The conference hosted self-custody workshops, educating thousands on hardware wallets (e.g., Ledger, Trezor) and best practices for private key management.

Retail engagement is critical for Bitcoin’s mainstream acceptance, as it democratizes access and fosters financial inclusion, particularly in underserved regions.

⚖️ Global Regulatory Landscape: Balancing Innovation and Oversight

Blockchain Consensus Algorithms

United States

The U.S. regulatory environment remains complex:

- The SEC and CFTC continue to dispute jurisdiction over cryptocurrencies, creating uncertainty for businesses and investors.

- The proposed Digital Asset Market Structure Bill aims to clarify oversight but remains pending in Congress as of July 2024.

- Bipartisan efforts, such as the Lummis-Gillibrand Responsible Financial Innovation Act, seek to balance innovation with consumer protection.

International Perspectives

- El Salvador: As the first nation to adopt Bitcoin as legal tender in 2021, it now has over 2,000 merchants accepting BTC, per government reports. Its Bitcoin City initiative, funded by Bitcoin bonds, aims to attract investment and leverage geothermal energy for mining.

- European Union: The Markets in Crypto-Assets (MiCA) regulation, effective in 2024, enforces Anti-Money Laundering (AML) and Know Your Customer (KYC) standards for crypto businesses, enhancing consumer trust while fostering innovation.

- Asia-Pacific:

- Singapore: Offers clear licensing frameworks, attracting global exchanges like Binance and Coinbase.

- India: Imposes a 30% tax on crypto gains and a 1% TDS on transactions, deterring retail participation.

- China: Maintains strict bans on crypto trading but permits limited mining in select regions.

Key Takeaways: Global Regulatory Trends

- U.S.: Regulatory uncertainty persists, pending legislation.

- El Salvador: Bitcoin as legal tender, with merchant adoption growing. 🇸🇻

- EU: MiCA promotes consumer protection and innovation. 🇪🇺

- Singapore: Crypto-friendly hub for exchanges. 🇸🇬

🌍 Socioeconomic Impact: Bitcoin’s Real-World Applications

Financial Inclusion

Bitcoin empowers unbanked and underbanked populations in regions like Venezuela, Argentina, and Zimbabwe, where hyperinflation and banking restrictions limit financial access. Mobile wallets, such as BlueWallet and Wallet of Satoshi, enable peer-to-peer transactions without intermediaries, providing financial autonomy to millions.

💸 Remittance Revolution

The Lightning Network facilitates over $1B in annual remittances, with fees as low as 0.1% compared to 6–7% for traditional services like Western Union, per Chainalysis (2024). This benefits migrant workers in regions like Southeast Asia, Latin America, and Africa, improving economic resilience.

🛡️ Censorship Resistance and Economic Sovereignty

Bitcoin’s decentralized nature ensures financial sovereignty in politically or economically unstable regions. For example, dissidents in authoritarian regimes use Bitcoin to bypass capital controls and sanctions, preserving access to funds and enabling economic freedom.

🇸🇻 Case Study: El Salvador’s Bitcoin Experiment

El Salvador’s adoption of Bitcoin as legal tender in 2021 has yielded mixed results:

- Successes: Over 20% of GDP flows through Bitcoin remittances, reducing costs for citizens.

- Challenges: Limited merchant adoption (~2,000 merchants) and technical infrastructure gaps hinder widespread use.

- Future Plans: The Bitcoin City project aims to leverage geothermal energy for mining and attract foreign investment through Bitcoin bonds.

El Salvador Bitcoin Adoption Metrics (July 2024)

| Metric | Value |

|---|---|

| Merchants Accepting BTC | ~2,000 |

| Remittances via Bitcoin | ~20% of GDP |

| Bitcoin City Funding | $1B (Bitcoin bonds) |

💻 Developer Ecosystem: Driving Innovation

The Bitcoin 2024 Conference hosted 50+ workshops and hackathons, fostering collaboration among developers. Key developments included:

- Bitcoin Core 25.0: Enhanced node efficiency and security with improved mempool management and fee estimation.

- Lightning Network Upgrades: LND and Core Lightning improved payment routing and reliability, supporting larger transaction volumes.

- Privacy Tools: Projects like Wasabi Wallet and JoinMarket advanced coinjoin techniques for enhanced transaction privacy.

- Education: Tracks on Bitcoin fundamentals, scam prevention, and advanced scripting onboarded novice developers.

The open-source community remains Bitcoin’s backbone, driving innovation and resilience through collaborative development.

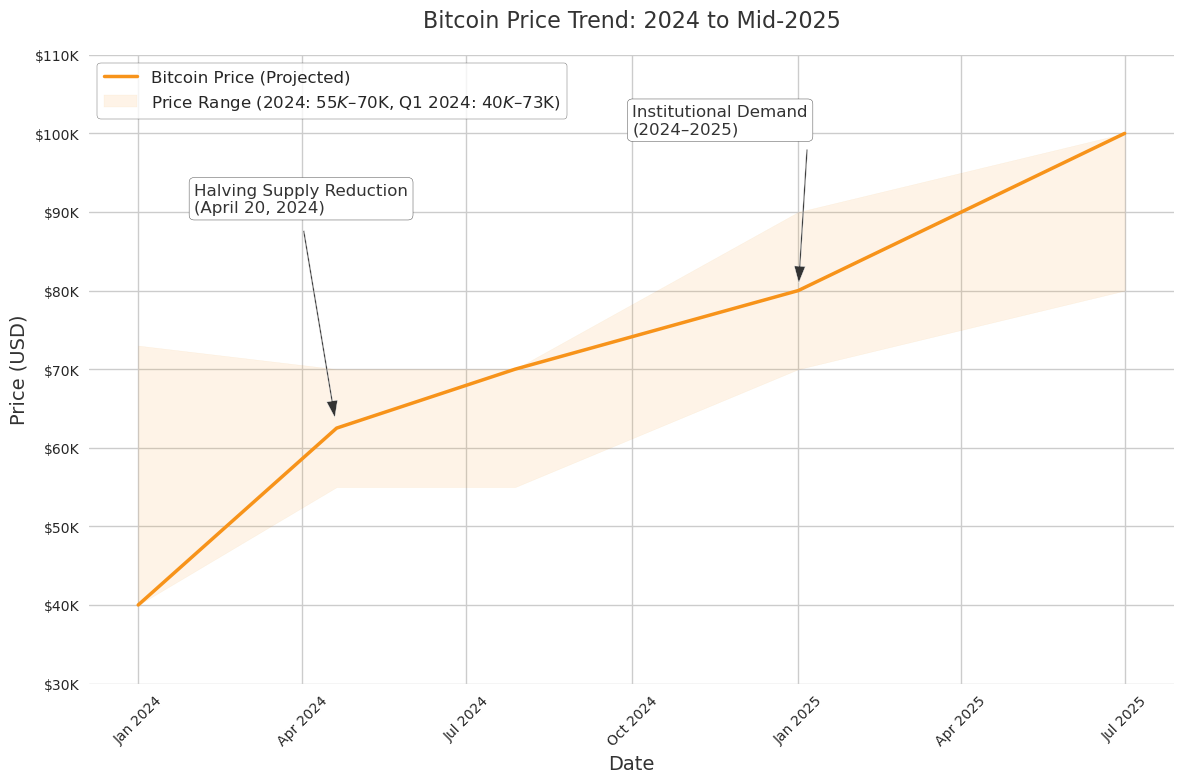

📊 Market Dynamics and Price Projections

Maturation as an Asset Class

Crypto Market Indicators and Analysis

Bitcoin’s declining volatility (28–33% annualized) reflects its maturation as an asset class. Institutional custody and expanding retail participation have reduced price swings, positioning Bitcoin as a viable portfolio diversifier alongside traditional assets like gold and equities.

Price Outlook

Market analysts project Bitcoin prices reaching $80,000–$100,000 by mid-2025, driven by:

- Supply Scarcity: Post-halving issuance of ~450 BTC/day tightens supply.

- Institutional Demand: ETF inflows and corporate treasury allocations boost buying pressure.

- Macroeconomic Factors: Persistent inflation and fiat currency devaluation enhance Bitcoin’s appeal as a hedge.

However, risks such as regulatory crackdowns, geopolitical tensions, or macroeconomic shifts could temper growth. For example, a strengthening U.S. dollar or tighter monetary policy could reduce speculative investment in cryptocurrencies.

Key Takeaways: Price Drivers

- Supply Reduction: Halving cuts daily issuance to ~450 BTC. 📉

- Institutional Buying: $8B in ETF inflows in 2024. 🏦

- Macro Trends: Inflation concerns boost Bitcoin’s appeal. 📈

🌿 Environmental Sustainability: Addressing the Energy Debate

Renewable Energy Adoption

The Bitcoin Mining Council’s Q2 2024 report estimated that 50% of Bitcoin mining used renewable energy sources, including hydroelectric, wind, and solar, up from 37% in 2021. Regions leading sustainable mining include:

- Canada: Abundant hydroelectric power.

- Scandinavia: Wind and hydroelectric resources.

- Texas: Solar and wind energy, supported by a deregulated grid.

Energy Efficiency

Next-generation ASIC miners, such as Bitmain’s S19 XP (21.5 J/TH) and MicroBT’s M50 (20.5 J/TH), reduced energy consumption compared to older models (~30 J/TH). These gains lowered Bitcoin’s energy intensity, aligning its environmental footprint closer to traditional financial systems like banking or credit card networks.

Grid Stabilization

Miners increasingly participate in demand response programs, stabilizing energy grids by curtailing operations during peak demand. For example, Texas miners returned 1 GW to the grid during 2024 heatwaves, per ERCOT data, supporting energy reliability and earning revenue through grid partnerships.

Table 4: Bitcoin Mining Sustainability Metrics (Q2 2024)

| Metric | Value |

|---|---|

| Renewable Energy Share | ~50% |

| Energy Efficiency (J/TH) | 20.5–21.5 |

| Grid Stabilization (Texas) | 1 GW returned |

🌐 Geopolitical and Macroeconomic Implications

Bitcoin’s decentralized nature offers an alternative financial infrastructure amid global geopolitical tensions:

- Sanctions Resistance: Enables individuals and entities to bypass restrictive financial controls, as seen in regions like Russia and Iran.

- Economic Resilience: Countries with unstable currencies, such as Turkey (lira depreciation) and Lebanon (banking crisis), see growing Bitcoin adoption.

- Regional Development: Mining operations create jobs and infrastructure in energy-rich regions, such as Paraguay and Kazakhstan.

Bitcoin’s role as a hedge against fiat currency devaluation and geopolitical uncertainty is increasingly recognized, particularly in emerging markets.

🔮 Future Trends and Challenges

Technological Trends

- Layer 2 Scaling: Lightning Network enhancements will improve usability and adoption for micropayments.

- Privacy Solutions: Advances in coinjoin and zero-knowledge proofs will enhance transaction privacy.

- DeFi Growth: Bitcoin-native DeFi protocols will expand, driven by sidechains and interoperability.

Challenges

- Regulatory Uncertainty: Inconsistent global policies could hinder adoption.

- Scalability: Lightning Network and sidechains must overcome usability barriers.

- Public Perception: Misconceptions about Bitcoin’s energy use and illicit activity require ongoing education.

Expert Insights

Conference speakers, including developers from Blockstream, Lightning Labs, and MicroStrategy, emphasized Bitcoin’s potential to reshape finance, provided scalability, privacy, and regulatory challenges are addressed.

Bitcoin 2024 FAQ

What was the Bitcoin 2024 Conference?

A global summit in Nashville focusing on Bitcoin’s post-halving trends, technology, regulation, and future outlook.

When did the 2024 halving occur?

April 20, 2024, at block 840,000.

How did Bitcoin’s price respond?

Stabilized between $55,000 and $70,000 with 28–33% volatility.

What are key Bitcoin technological advancements?

Taproot, Schnorr signatures, Lightning Network, and sidechains like Liquid and RSK.

How is Bitcoin regulated globally?

Varies: U.S. faces uncertainty, El Salvador adopts Bitcoin, EU enforces MiCA, and Asia-Pacific has mixed policies.

How does Bitcoin support financial inclusion?

Enables P2P transactions for unbanked populations and low-cost remittances.

Is Bitcoin environmentally sustainable?

~50% of mining uses renewables, with efficiency gains reducing its footprint.

What is Bitcoin’s future outlook?

Analysts project $80,000–$100,000 by mid-2025, driven by scarcity and adoption.

🏁 Conclusion: Bitcoin’s Ascendance as a Global Force

The Bitcoin 2024 Conference reaffirmed Bitcoin’s evolution from a niche experiment to a transformative financial technology shaping global economics, governance, and personal sovereignty. The halving reinforced its scarcity, technological advancements expanded its utility, and growing institutional and retail adoption solidified its role in the financial ecosystem. As regulatory clarity improves and sustainability efforts advance, Bitcoin is poised to redefine money and empower individuals through 2025 and beyond.

Sources

- Blockchain.com (hash rate, circulating supply)

- CoinGecko, CoinMarketCap (price, market cap)

- Bitcoin Mining Council (Q2 2024 renewable energy report)

- 1ML.net (Lightning Network statistics)

- Bloomberg (ETF inflows)

- DeFiLlama (Bitcoin DeFi TVL)

- Bitcoin Core release notes (v25.0)

- Chainalysis (remittance data)

- SEC filings (MicroStrategy, Tesla holdings)

- ERCOT (Texas grid data)

- El Salvador government reports

- Conference materials and press releases

Discussion